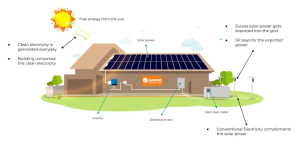

Arizona’s $1,000 solar rebate program is a visionary approach to accelerating the adoption of renewable energy sources. The state’s innovative $1,000 solar rebate program not only encourages the adoption of renewable energy but also serves as a catalyst for economic growth, environmental stewardship, and energy independence.

Arizona is setting an example for other states to follow. With every solar panel installation, homeowners contribute to a cleaner environment, a stronger economy, and a more resilient energy infrastructure. They also reap the rewards of reduced energy costs.

If you are considering going solar, be sure to factor in the available incentives to see how much you can save. This program is a win-win for everyone involved. Homeowners save money, the environment benefits, and Arizona becomes a leader in the clean energy movement.

The application process for the $1000 rebate is relatively simple. However, it is important to keep all of your documentation in order to avoid any delays in the approval process.

To qualify for the rebate, residents must purchase and install solar panels that are certified by the Solar Energy Industries Association (SEIA). The solar panels must also be installed by a licensed solar installer.

To apply for the rebate, residents simply submit an application form and proof of purchase to the Arizona Department of Revenue. The application form can be found on the department’s website. Link here https://azdor.gov/news-center/income-tax-credit-residential-solar-devices.

Also important to know:

The installation of a solar power system contributes to the appreciation of your home’s value. Remarkably, Arizona extends a property tax exemption that absolves you from paying taxes on this augmented value. The scope of this exemption encompasses more than just solar panel systems; it also encompasses various solar and efficiency enhancements. Included in this exemption are:

- Passive solar technologies, are exemplified by features like Trombe walls.

- Solar pool heating systems.

- Solar space heating systems.

- Solar thermal electric systems.

- Solar water heating systems.

To initiate the process of securing this tax exemption, you will need to meticulously document the entire journey of your energy system acquisition, installation, and associated expenses. This documentation should be presented to your county assessor. For an in-depth understanding of the Arizona property tax exemption, you can find comprehensive information on the DSIRE website.