Solar energy not only provides an eco-friendly alternative to traditional energy sources. This can significantly cut utility bills. Further encouraging homeowners to make the switch is the Inflation Reduction Act for Solar Power. Making solar power even more accessible.

Understanding the Inflation Reduction Act for Solar Power

The Inflation Reduction Act for Solar Power is a law passed in 2022 that aims to reduce inflation and the country’s deficit. It includes provisions to lower the cost of investing in domestic energy production and promote clean energy. The act also provides financial help and incentives to homeowners who want to invest in solar panels for their homes.

Solar Power as a Solution

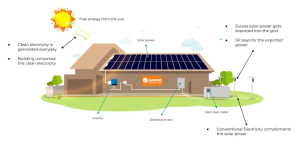

Smart homeowners are switching to solar because it is more efficient, affordable, and accessible than ever before. Solar energy systems harness the sun’s energy to generate electricity. This reduces reliance on fossil fuels and cutting greenhouse gas emissions.

A significant aspect of the Inflation Reduction Act for Solar Power is the 30% Residential Clean Energy Credit. This federal tax credit allows homeowners to deduct 30% of their solar installation costs from their federal income tax. For example, if you invest $40,000 in a solar system, you receive a $12,000 credit on your taxes. This incentive not only reduces your installation cost but also your tax liability.

Taking Advantage of the Inflation Reduction Act for Solar Power

Homeowners who want to leverage the Inflation Reduction Act for solar power tax credits need to meet a few basic criteria:

- Tax Liability: To take full advantage of the credit, you should have enough tax liability. This means you need to owe at least as much in taxes as the credit’s value.

- Property Ownership: You must own the property where the solar panels are installed. If you are renting or leasing your home, you won’t qualify for the tax credit.

- Primary Residence: The solar system should be installed on your primary residence. Vacation homes and rental properties typically do not qualify for the tax credit.

The credit itself is not a one-time benefit. If your tax liability isn’t high enough to absorb the entire credit in a single year, the excess credit can often be rolled over to future years.. This means that more people can now afford to go solar and save money on their energy bills.

Understanding State-Level Benefits

State solar incentives can make solar power even more affordable, in addition to the federal solar tax credit. State incentives vary, so homeowners should explore the programs available in their specific area.

For instance, Arizona offers rebates of up to $1,000 for solar systems.

You can combine state and federal solar incentives to save even more money on your solar installation.

Exploring Performance-Based Incentives

Performance-based incentives (PBIs) are another way homeowners can benefit from their solar systems. These incentives are based on the energy production of a solar system. The more energy your solar panels produce, the more you earn in incentives. PBIs encourage homeowners to focus on system performance and regular maintenance.

Performance-based incentives (PBIs) pay homeowners for the electricity their solar panels produce.

The Role of Renewable Energy Certificates

Renewable Energy Certificates (RECs) play a vital role in promoting clean energy. These certificates allow homeowners to sell renewable energy back to utilities. This is especially important because utilities often need a certain number of RECs

References for Inflation Reduction Act for Solar Power:

- Department of Energy: This page provides information on the Solar Investment Tax Credit and how it has been expanded by the Inflation Reduction Act.

- The White House: This page provides information on Direct Pay, which is a part of the Inflation Reduction Act that allows applicable entities to use direct pay for 12 of the act’s tax credits, including those for generating clean electricity through solar, wind, and battery storage projects.

- IRS: This page provides guidance for owners of solar and wind powered energy facilities in low-income communities for increased energy credit under the Inflation Reduction Act.

- IRS: This page provides information on credits and deductions under the Inflation Reduction Act of 2022, including the energy credit for solar and wind facilities.

- IRS: This page provides information on the increased energy investment credit for solar and wind facilities benefitting low-income communities under the Inflation Reduction Act.