Solar incentives are designed to encourage more people to embrace solar energy. Saving on installation costs and reducing monthly electricity bills. In this article, we’ll break down the two main types, rebates and tax credits. Additionally, we’ll guide you on how to use these incentives and maximize your savings.

Solar energy is gaining momentum as a clean and sustainable source of power. Incentives make solar energy more affordable for a broader range of individuals. By understanding the incentives and how to use them to make an informed decision.

Types of Solar Incentives

They primarily fall into two categories: rebates and tax credits. These help offset the cost of going solar, making it more appealing for homeowners.

Rebates are like one-time cash rewards provided by local utilities, government agencies, or both. They aim to reduce the upfront expense of solar installation.

Tax Credits decreases your income tax liability, particularly the federal solar tax credit. For instance, the federal solar investment tax credit (ITC) currently covers 30% of your solar system’s cost.

Common Solar Incentives

Now, let’s explore some of the most common types:

- Federal Solar Investment Tax Credit (ITC): The federal ITC is a crucial incentive available to all homeowners. It’s currently set at 30% of the total system cost but is scheduled to decrease in the coming years.

- State Solar Rebates: Many states offer rebates to homeowners who install solar panels. The rebate amounts vary from state to state, making solar adoption more attractive.

- Performance-Based Incentives (PBIs): PBIs reward homeowners based on their solar system’s energy production. These incentives motivate homeowners to choose high-quality systems and ensure proper maintenance.

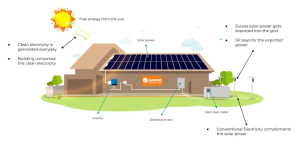

- Net Energy Metering (NEM) allows you to sell excess solar energy back to the utility company. This surplus energy offsets their monthly electricity bills.

How to Find Solar Incentives

For a list available in your area, use the Database of State Incentives for Renewables & Efficiency (DSIRE)

StarQuest Solar can provide valuable information about solar incentives in your region.

Maximizing Your Solar Savings

To maximize your savings, follow these tips:

- Local and state incentives can be combined with the federal solar tax credit. This results in even more savings.

- Battery Storage uses excess solar energy for later use, such as during nighttime or cloudy days. These systems may also qualify for government and state incentives.

- Various financing options, including loans and leases, can make solar systems more affordable.

Solar incentives play a crucial role in the adoption of solar energy and the transition to a more sustainable energy future.

References

Database of State Incentives for Renewables & Efficiency (DSIRE). (2023). Retrieved from DSIRE

The significance of solar incentives helps you choose solar wisely. These financial advantages help in the short and long run. This is making clean energy easier and more sustainable. Why delay? Begin checking out local solar incentives now to step into a greener, energy-efficient future.