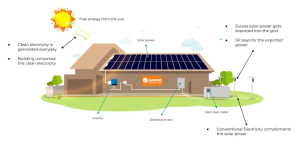

Solar power is gaining enormous popularity as a reliable energy source, it’s essential to recognize that financing your solar journey has never been more accessible or advantageous. In this article, we delve into the world of solar financing, shedding light on the diverse options available to empower you to harness the sun’s energy and secure your energy independence.

Solar financing has undergone a transformative evolution, making solar energy systems more attainable for homeowners and businesses alike. No longer reserved for the financially affluent, solar financing solutions have democratized access to renewable energy, allowing you to enjoy immediate savings and contribute to a greener planet.

Solar financing offers a spectrum of options tailored to your unique needs and financial goals. From loans and leases to power purchase agreements (PPAs), you have the flexibility to choose the financing model that aligns with your budget and preferences.

Solar Loans: Secure a loan to cover the upfront costs of your solar installation, with the advantage of owning the system and benefiting from federal tax incentives and local rebates. As you repay the loan, you’ll witness a reduction in your energy bills while building equity in your solar asset.

Solar Leases: Leasing your solar system means you can enjoy the benefits of solar energy without the initial investment. Lease payments are typically lower than your previous electricity bills, offering immediate savings. Plus, maintenance and monitoring services are often included, ensuring hassle-free solar ownership.

Beyond immediate savings on your energy bills, solar financing offers a host of financial advantages that make the transition to solar power even more compelling:

a. Tax Incentives: Take advantage of federal tax credits, which can significantly reduce the overall cost of your solar installation.

b. Increased Property Value: Installing solar panels can increase the resale value of your property, making it a more attractive option for potential buyers.

c. Environmental Stewardship: Demonstrating your commitment to sustainability through solar energy can enhance your brand image and appeal to environmentally conscious consumers.

Solar interest rates have been on the decline in recent years, making it more affordable for homeowners to switch to solar power. In 2023, the average interest rate for a solar loan is around 5.99%, which is significantly lower than the average interest rate for a traditional home equity loan.

There are a few factors that have contributed to the decline in solar interest rates. First, the cost of solar panels has been declining, making solar power more affordable overall. Second, the demand for solar power has been increasing, which has created more competition among solar lenders. Third, the government has offered tax credits and other incentives to homeowners who install solar panels, which has also helped to lower the cost of solar power.

The decline in solar interest rates is good news for homeowners who are considering switching to solar power. It means that they can now finance their solar panels with a lower interest rate, which will save them money on their monthly payments.

If you are considering switching to solar power, be sure to compare interest rates from multiple solar lenders. You can also ask your solar installer for recommendations.

Here are some of the factors that can affect solar interest rates:

- Your credit score: Your credit score is one of the most important factors that solar lenders will consider when determining your interest rate. A higher credit score will typically lead to a lower interest rate.

- The size of your solar system: The size of your solar system will also affect your interest rate. A larger solar system will typically require a larger loan, which will lead to a higher interest rate.

- Your location: The location of your home can also affect your interest rate. Solar lenders typically charge higher interest rates in areas with less sunlight.

- The type of solar financing you choose: There are different types of solar financing available, each with its own interest rate. Solar loans typically have lower interest rates than solar leases or PPAs.

Here are some of the most popular solar finance companies:

- GoodLeap is a finance technology company that provides financing options for the residential solar energy industry. The company was founded in 2003 as Paramount Equity and was later rebranded to Loanpal. In June 2021, the company rebranded to GoodLeap. As of 2023, the company was responsible for 41% of the solar loan market in the U.S. and is the top solar lender in the country.

- Sunlight Financial is a national solar lender that offers solar loans and leases to homeowners across the United States. The company has a simple and easy application process, and it offers competitive rates on its loans and leases.

- LightStream is a division of Light Financial that offers personal loans, including solar loans. The company has competitive rates and a simple application process.

- SunPower not only manufactures high-efficiency solar panels but also offers solar financing solutions, including solar leases and loans. They have been recognized for their quality products and innovative financing options.

- Vivint Solar is known for its full-service approach, offering solar panel installation as well as financing options such as leases and loans. They have a significant presence in the residential solar market.

- LoanPal is a solar loan provider that partners with various solar installation companies to offer financing options to homeowners. They aim to simplify the financing process and make it more affordable for customers to go solar.

- Dividend Finance provides solar loans and other financing solutions for residential solar installations. They aim to make clean energy more accessible by offering competitive rates and flexible terms.

- Mosaic specializes in providing solar loans and home improvement loans for various energy-efficient upgrades, including solar panel installations. They have been recognized for their straightforward financing process.

- GreenSky offers financing solutions for a range of home improvement projects, including solar installations. They partner with a network of contractors to provide financing options to homeowners.

- Wells Fargo is a well-known financial institution that offers solar loans and financing options for residential solar projects. They have a broad reach and provide traditional lending options for solar adoption.

- CIT Group offers financing solutions for various industries, including solar energy. They provide financing options for commercial and industrial solar projects.

- Renew Financial focuses on Property Assessed Clean Energy (PACE) financing, which allows homeowners to finance solar and energy-efficient upgrades through their property taxes.

Solar financing has revolutionized the way we think about energy. By offering a range of customizable financing options, it has empowered homeowners and businesses to embark on a sustainable energy journey with confidence. As the world pivots towards renewable energy solutions, solar financing stands as a beacon of hope, guiding us towards a brighter, cleaner, and more economically savvy future. Unleash the power of the sun and embrace soar financing today, securing a greener tomorrow for generations to come.